-

Posts

60 -

Joined

-

Last visited

Everything posted by BlackSun

-

Is 'Made in America' being tied to Unions?

BlackSun replied to Luke_Wilbur's topic in United States Politics

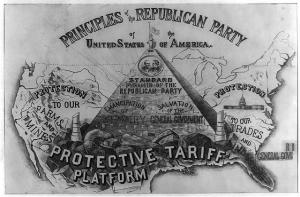

Protecting American interests was a platform of the Republican Party in the past. Click on the image to see it in larger format. -

Follow the instructions.

-

Skype provided more details about why its voice over IP service has been affected yesterday and today and it highlights the very important role of supernodes which act like the middlemen to connect Skype users. The company's Peer to Peer telephony technology should have, in theory, allowed it to function without disruption even if computers go down. Clearly, the service did not buckle under pressure on the build-up to Christmas but then, it remains a mystery why so many supernodes were taken down almost simultaneously. Supernodes represent a tiny fraction of hundreds of thousands of computers that form the Skype network; the company says of supernodes that "a small percentage of our users will hold a record reflecting the online presence of other users. When one user holds a record concerning the presence of other users, the former is called a supernode or directory node." It is not clear how Skype chooses which computers should become supernodes and whether supernodes are constantly change (although we doubt it) but users are certainly not aware of the fact that their computers may have become a node directory. Read more: http://www.itproportal.com/2010/12/23/skype-down-were-supernodes-hacked/

-

Eight individuals were arrested Sunday for allegedly carrying out long-term, "deep-cover" assignments in the United States on behalf of the Russian Federation, the Justice Department announced today. Two additional defendants were also arrested Sunday for allegedly participating in the same Russian intelligence program within the United States. In total, 11 defendants, including the 10 arrested, are charged in two separate criminal complaints with conspiring to act as unlawful agents of the Russian Federation within the United States. Federal law prohibits individuals from acting as agents of foreign governments within the United States without prior notification to the U.S. Attorney General. Nine of the defendants are also charged with conspiracy to commit money laundering. The defendants known as "Richard Murphy" and "Cynthia Murphy" were arrested yesterday by FBI agents at their residence in Montclair, N.J., and are expected to appear in federal court in Manhattan today. Vicky Pelaez and the defendant known as "Juan Lazaro" were arrested yesterday at their residence in Yonkers, N.Y., and are expected to appear in federal court in Manhattan today. Anna Chapman was arrested in Manhattan yesterday and is expected to appear in federal court in Manhattan today. The defendants known as "Michael Zottoli" and "Patricia Mills" were arrested yesterday at their residence in Arlington, Va., and are appearing in federal court in Alexandria, Va., today. Defendant Mikhail Semenko was arrested yesterday at his residence in Arlington and is appearing in federal court in Alexandria today. In addition, the defendants known as "Donald Howard Heathfield" and "Tracey Lee Ann Foley" were arrested at their residence in Boston yesterday and are appearing in federal court in Boston today. The defendant known as "Christopher R. Metsos" remains at large. The charges are filed in U.S. District Court for the Southern District of New York. The charge of conspiracy to act as an agent of a foreign government without notifying the U.S. Attorney General carries a maximum penalty of five years in prison. All the defendants are charged with this violation. The charge of conspiracy to commit money laundering carries a maximum penalty of 20 years in prison. All the defendants except Chapman and Semenko are charged with this violation. This case is the result of a multi-year investigation conducted by the FBI; the U.S. Attorney’s Office for the Southern District of New York; and the Counterespionage Section and the Office of Intelligence within the Justice Department’s National Security Division. The prosecution is being handled by Assistant U.S. Attorneys Michael Farbiarz, Glen Kopp and Jason Smith of the Terrorism and International Narcotics Unit of the U.S. Attorney’s Office for the Southern District of New York, and Trial Attorneys Kathleen Kedian and Richard Scott of the Counterespionage Section of the Justice Department’s National Security Division. The charges and allegations contained in the criminal complaints are merely allegations, and the defendants are presumed innocent unless and until proven guilty. Download the documents: Complaint #1 (PDF) Complaint #2 (PDF)

-

I am not into the game of politics. But.... One thing stood out to me on the President's speech to the nation. Right after means 20 days after???? http://www.deepwaterhorizonresponse.com/go/doc/2931/546651/ It looks like Administration is going to have a hard time explaining this.

-

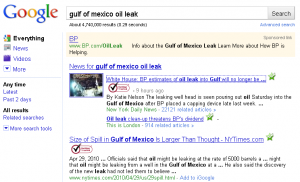

I personally do not think Google allowing BP to buy all terms associated with the oil spill is not ethical.

-

The best way to get a perspective of the magnitude of this oil spill is to visualize it over your home town. Here is an example. http://www.beowulfe.com/oil/#loc=Washington%2C%20DC%2C%20USA&lat=38.8951118&lng=-77.0363658&x=-77.0363658&y=38.8951118&z=7

-

Good point. OrgName: New Dream Network, LLC OrgID: NDN Address: 417 Associated Rd. Address: PMB #257 City: Brea StateProv: CA PostalCode: 92821 Country: US eutimes.net SOA server: ns1.dreamhost.com email: hostmaster@dreamhost.com serial: 2010032700 refresh: 21408 retry: 1800 expire: 1814400 minimum ttl: 14400 14400s eutimes.net A 69.163.221.114 14400s eutimes.net MX preference: 0 exchange: mx2.sub4.homie.mail.dreamhost.com 14400s eutimes.net NS ns1.dreamhost.com 14400s eutimes.net NS ns3.dreamhost.com 14400s eutimes.net NS ns2.dreamhost.com 14400s eutimes.net MX preference: 0 exchange: mx1.sub4.homie.mail.dreamhost.com 14400s Authority records Additional records mx1.sub4.homie.mail.dreamhost.com A 208.97.132.226 14400s mx2.sub4.homie.mail.dreamhost.com A 208.97.132.227 14400s ns1.dreamhost.com A 66.33.206.206 14400s ns2.dreamhost.com A 208.96.10.221 14400s ns3.dreamhost.com A 66.33.216.216 14400s http://wiki.dreamhost.com/ Registrant: Contactprivacy.com 96 Mowat Ave Toronto, ON M6K 3M1 CA Registrant is cited as: Registrant: Jessica Nachtman 16435 E. Stallion Dr. Loxahatchee, FL 33470 US

-

This story appears to originate from a group called "Sorcha Faal." Most people believe that "Sorcha Faal" is actually David Booth. Fax: PO Box 841 C/O whatdoesitmean.com Yarmouth, NS B5A 4K5 CA David Booth is cited as the Registrant and Administrator for whatdoesitmean.com.

-

People need to check this story out now!!!!! I do hope it is a rumor. US Orders Blackout Over North Korean Torpedoing Of Gulf Of Mexico Oil Rig

-

Securities and Exchange Commission v. Goldman, Sachs & Co. and Fabrice Tourre, 10 Civ. 3229 (BJ) (S.D.N.Y. filed April 16, 2010) The SEC Charges Goldman Sachs With Fraud In Connection With The Structuring And Marketing of A Synthetic CDO The Securities and Exchange Commission today filed securities fraud charges against Goldman, Sachs & Co. ("GS&Co") and a GS&Co employee, Fabrice Tourre ("Tourre"), for making material misstatements and omissions in connection with a synthetic collateralized debt obligation ("CDO") GS&Co structured and marketed to investors. This synthetic CDO, ABACUS 2007-AC1, was tied to the performance of subprime residential mortgage-backed securities ("RMBS") and was structured and marketed in early 2007 when the United States housing market and the securities referencing it were beginning to show signs of distress. Synthetic CDOs like ABACUS 2007-AC1 contributed to the recent financial crisis by magnifying losses associated with the downturn in the United States housing market. According to the Commission's complaint, the marketing materials for ABACUS 2007-AC1 — including the term sheet, flip book and offering memorandum for the CDO — all represented that the reference portfolio of RMBS underlying the CDO was selected by ACA Management LLC ("ACA"), a third party with expertise in analyzing credit risk in RMBS. Undisclosed in the marketing materials and unbeknownst to investors, a large hedge fund, Paulson & Co. Inc. ("Paulson"), with economic interests directly adverse to investors in the ABACUS 2007-AC1 CDO played a significant role in the portfolio selection process. After participating in the selection of the reference portfolio, Paulson effectively shorted the RMBS portfolio it helped select by entering into credit default swaps ("CDS") with GS&Co to buy protection on specific layers of the ABACUS 2007-AC1 capital structure. Given its financial short interest, Paulson had an economic incentive to choose RMBS that it expected to experience credit events in the near future. GS&Co did not disclose Paulson's adverse economic interest or its role in the portfolio selection process in the term sheet, flip book, offering memorandum or other marketing materials. The Commission alleges that Tourre was principally responsible for ABACUS 2007-AC1. According to the Commission's complaint, Tourre devised the transaction, prepared the marketing materials and communicated directly with investors. Tourre is alleged to have known of Paulson's undisclosed short interest and its role in the collateral selection process. He is also alleged to have misled ACA into believing that Paulson invested approximately $200 million in the equity of ABACUS 2007-AC1 (a long position) and, accordingly, that Paulson's interests in the collateral section process were aligned with ACA's when in reality Paulson's interests were sharply conflicting. The deal closed on April 26, 2007. Paulson paid GS&Co approximately $15 million for structuring and marketing ABACUS 2007-AC1. By October 24, 2007, 83% of the RMBS in the ABACUS 2007-AC1 portfolio had been downgraded and 17% was on negative watch. By January 29, 2008, 99% of the portfolio had allegedly been downgraded. Investors in the liabilities of ABACUS 2007-AC1 are alleged to have lost over $1 billion. Paulson's opposite CDS positions yielded a profit of approximately $1 billion. The Commission's complaint, which was filed in the United States District Court for the Southern District of New York, charges GS&Co and Tourre with violations of Section 17(a) of the Securities Act of 1933, 15 U.S.C. §77q( a ), Section 10( B ) of the Securities Exchange Act of 1934, 15 U.S.C. §78j( B ) and Exchange Act Rule 10b-5, 17 C.F.R. §240.10b-5. The Commission seeks injunctive relief, disgorgement of profits, prejudgment interest and civil penalties from both defendants. The Commission's investigation is continuing into the practices of investment banks and others that purchased and securitized pools of subprime mortgages and the resecuritized CDO market with a focus on products structured and marketed in late 2006 and early 2007 as the U.S. housing market was beginning to show signs of distress.

-

Banks vs. American People - Can Wall Street Reform Be Done?

BlackSun replied to a topic in United States Politics

Goldman Sachs and Tourre violated the federal securities laws and made illegal profits from fraudulent statements to investors. Their scheme was investors to purchase securities-based swap agreements obtained money or property by means of untrue statements. Goldman Sachs and Tourre knowingly or recklessly misrepresented in the term sheet, flip book and offering memorandum for ABACUS 2007-ACI that the reference portfolio was selected by ACA Capital Holdings, Inc. without disclosing the significant role in the portfolio selection process played by Paulson & Co. Inc. ("Paulson"), a hedge fund with financial interests in the transaction adverse to IKE, ACA Capital Holdings, Inc. and ABN. Goldman Sachs and Tourre also knowingly or recklessly misled ACA into believing that Paulson invested in the equity of ABACUS 2007-ACI and, accordingly, that Paulson's interests in the collateral section process were closely aligned with ACA's when in reality their interests were sharply conflicting. Unbeknownst to ABN, Paulson played a significant role in the collateral selection process and had a financial interest in the transaction that was adverse to ACA Capital Holdings, Inc. Capital and ABN. http://www.sec.gov/litigation/complaints/2010/comp21489.pdf -

Goldman Sachs and Morgan Stanley Are Now Bank Holding Companies

BlackSun replied to Luke_Wilbur's topic in Economy

The End is Beginning.. SEC Charges Goldman Sachs With Fraud in Structuring and Marketing of CDO Tied to Subprime Mortgages The Securities and Exchange Commission today charged Goldman, Sachs & Co. and one of its vice presidents for defrauding investors by misstating and omitting key facts about a financial product tied to subprime mortgages as the U.S. housing market was beginning to falter. The SEC alleges that Goldman Sachs structured and marketed a synthetic collateralized debt obligation (CDO) that hinged on the performance of subprime residential mortgage-backed securities (RMBS). Goldman Sachs failed to disclose to investors vital information about the CDO, in particular the role that a major hedge fund played in the portfolio selection process and the fact that the hedge fund had taken a short position against the CDO. "The product was new and complex but the deception and conflicts are old and simple," said Robert Khuzami, Director of the Division of Enforcement. "Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio, while telling other investors that the securities were selected by an independent, objective third party." Kenneth Lench, Chief of the SEC's Structured and New Products Unit, added, "The SEC continues to investigate the practices of investment banks and others involved in the securitization of complex financial products tied to the U.S. housing market as it was beginning to show signs of distress." The SEC alleges that one of the world's largest hedge funds, Paulson & Co., paid Goldman Sachs to structure a transaction in which Paulson & Co. could take short positions against mortgage securities chosen by Paulson & Co. based on a belief that the securities would experience credit events. According to the SEC's complaint, filed in U.S. District Court for the Southern District of New York, the marketing materials for the CDO known as ABACUS 2007-AC1 (ABACUS) all represented that the RMBS portfolio underlying the CDO was selected by ACA Management LLC (ACA), a third party with expertise in analyzing credit risk in RMBS. The SEC alleges that undisclosed in the marketing materials and unbeknownst to investors, the Paulson & Co. hedge fund, which was poised to benefit if the RMBS defaulted, played a significant role in selecting which RMBS should make up the portfolio. The SEC's complaint alleges that after participating in the portfolio selection, Paulson & Co. effectively shorted the RMBS portfolio it helped select by entering into credit default swaps (CDS) with Goldman Sachs to buy protection on specific layers of the ABACUS capital structure. Given that financial short interest, Paulson & Co. had an economic incentive to select RMBS that it expected to experience credit events in the near future. Goldman Sachs did not disclose Paulson & Co.'s short position or its role in the collateral selection process in the term sheet, flip book, offering memorandum, or other marketing materials provided to investors. The SEC alleges that Goldman Sachs Vice President Fabrice Tourre was principally responsible for ABACUS 2007-AC1. Tourre structured the transaction, prepared the marketing materials, and communicated directly with investors. Tourre allegedly knew of Paulson & Co.'s undisclosed short interest and role in the collateral selection process. In addition, he misled ACA into believing that Paulson & Co. invested approximately $200 million in the equity of ABACUS, indicating that Paulson & Co.'s interests in the collateral selection process were closely aligned with ACA's interests. In reality, however, their interests were sharply conflicting. According to the SEC's complaint, the deal closed on April 26, 2007, and Paulson & Co. paid Goldman Sachs approximately $15 million for structuring and marketing ABACUS. By Oct. 24, 2007, 83 percent of the RMBS in the ABACUS portfolio had been downgraded and 17 percent were on negative watch. By Jan. 29, 2008, 99 percent of the portfolio had been downgraded. Investors in the liabilities of ABACUS are alleged to have lost more than $1 billion. The SEC's complaint charges Goldman Sachs and Tourre with violations of Section 17( a ) of the Securities Act of 1933, Section 10( B ) of the Securities Exchange Act of 1934, and Exchange Act Rule 10b-5. The Commission seeks injunctive relief, disgorgement of profits, prejudgment interest, and financial penalties. # # # For more information about this enforcement action, contact: Lorin L. Reisner Deputy Director, SEC Enforcement Division (202) 551-4787 Kenneth R. Lench Chief, Structured and New Products Unit, SEC Enforcement Division (202) 551-4938 Reid A. Muoio Deputy Chief, Structured and New Products Unit, SEC Enforcement Division (202) 551-4488 -

Verizon Customer Service Is A Nightmare

BlackSun replied to Luke_Wilbur's topic in Consumer Complaints

The End Begins... http://www.youtube.com/watch?v=8IezTZ8Fcj0 -

The Chinese Cyber-Invasion - Using American Computer Firms

BlackSun replied to a topic in Science and Technology

The Chinese are getting really bold. Here is a statement from Google on their recent Cyber attack. It appears that China's aim is to control what people say outside China about them. http://googleblog.blogspot.com/2010/01/new-approach-to-china.html -

Digital Strip Searches Coming to an Airport Near You

BlackSun replied to a topic in United States Politics

Deepak Chopra presided over the NASDAQ Market Open on Wednesday, September 22, 2004 at 9:30 am Eastern Time. OSI Systems has been listed on The NASDAQ National Market since October of 1997. Deepak Chopra Chief Executive Officer Deepak Chopra is the founder of OSI and has served as president, chief executive officer and a director of that company since OSI's inception in May 1987. He has served as OSI's chairman since February 1992. Deepak also serves as the president and chief executive officer of the Company's major subsidiaries. From 1976 to 1979 and from 1980 to 1987, Deepak held various positions with ILC Technology, Inc. ("ILC"), a publicly-held manufacturer of lighting products, including serving as chairman chief executive officer, president and chief operating officer of its United Detector Technology division. In 1990, OSI acquired certain assets of ILC's United Detector Technology division. Deepak has also held various positions with Intel Corporation, TRW Semiconductors and RCA Semiconductors. Deepak holds a Bachelor of Science degree in Electronics and a Master of Science degree in Semiconductor Electronics. Ajay Mehra Executive V.P., OSI Systems, Inc. -

Here is an amazing holographic 3D projection.

-

The technology is really close. The sad thing is our sky is going to be filled with advertisements once the marketing trade get their hands on it. http://www.youtube.com/watch?v=XOSx7v87JCA

-

FISHING SPAM Domain ID:D157449764-LROR Domain Name:UPDATELS.ORG Created On:27-Oct-2009 14:24:36 UTC Last Updated On:27-Oct-2009 14:24:38 UTC Expiration Date:27-Oct-2010 14:24:36 UTC Sponsoring Registrar:eNom, Inc. (R39-LROR) Status:CLIENT TRANSFER PROHIBITED Status:TRANSFER PROHIBITED Status:ADDPERIOD Registrant ID:e7a018c0d3c72943 Registrant Name:Andrew Hamilton Registrant Organization:- Registrant Street1:Nastipaya Gaz 12/z Registrant Street2: Registrant Street3: Registrant City:Warszawa Registrant State/Province:PL Registrant Postal Code:13119 Registrant Country:PL Registrant Phone:+484.7944125 Registrant Phone Ext.: Registrant FAX: Registrant FAX Ext.: Registrant Email:ahamilton6776@gmail.com Admin ID:e7a018c0d3c72943 Admin Name:Andrew Hamilton Admin Organization:- Admin Street1:Nastipaya Gaz 12/z Admin Street2: Admin Street3: Admin City:Warszawa Admin State/Province:PL Admin Postal Code:13119 Admin Country:PL Admin Phone:+484.7944125 Admin Phone Ext.: Admin FAX: Admin FAX Ext.: Admin Email:ahamilton6776@gmail.com Tech ID:e7a018c0d3c72943 Tech Name:Andrew Hamilton Tech Organization:- Tech Street1:Nastipaya Gaz 12/z Tech Street2: Tech Street3: Tech City:Warszawa Tech State/Province:PL Tech Postal Code:13119 Tech Country:PL Tech Phone:+484.7944125 Tech Phone Ext.: Tech FAX: Tech FAX Ext.: Tech Email:ahamilton6776@gmail.com Name Server:DNS1.NAME-SERVICES.COM Name Server:DNS2.NAME-SERVICES.COM Name Server:DNS3.NAME-SERVICES.COM Name Server:DNS4.NAME-SERVICES.COM Name Server:DNS5.NAME-SERVICES.COM Name Server: Name Server: Name Server: Name Server: Name Server: Name Server: Name Server: Name Server: DNSSEC:Unsigned Network IP address lookup: Whois query for ... Query error: No whois server known for the given domain

-

The Chinese Cyber-Invasion - Using American Computer Firms

BlackSun replied to a topic in Science and Technology

Here is a Symantec video describes the inner workings of the toolset used to create Backdoor.Ghostnet and control compromised computers. http://www.youtube.com/watch?v=Vz-gg8hxaVQ -

The Chinese Cyber-Invasion - Using American Computer Firms

BlackSun replied to a topic in Science and Technology

A mystery electronic spy network apparently based in China has infiltrated hundreds of computers around the world and stolen files and documents, Canadian researchers have revealed. The network, dubbed GhostNet, appears to target embassies, media groups, NGOs, international organisations, government foreign ministries and the offices of the Dalai Lama, leader of the Tibetan exile movement. The researchers, based at Toronto University's Munk Centre for International Studies, said their discovery had profound implications. "This report serves as a wake-up call... these are major disruptive capabilities that the professional information security community, as well as policymakers, need to come to terms with rapidly," said researchers Ron Deibert and Rafal Rohozinski. After 10 months of study, the researchers concluded that GhostNet had invaded 1,295 computers in 103 countries, but it appeared to be most focused on countries in south Asia and south-east Asia, as well as the Dalai Lama's offices in India, Brussels, London and New York. The network continues to infiltrate dozens of new computers each week. Such a pattern, and the fact that the network seemed to be controlled from computers inside China, could suggest that GhostNet was set up or linked to Chinese government espionage agencies. However, the researchers were clear that they had not been able to identify who was behind the network, and said it could be run by private citizens in China or a different country altogether. A Chinese government spokesmen has denied any official involvement. GhostNet can invade a computer over the internet and penetrate and steal secret files. It can also turn on the cameras and microphones of an infected computer, effectively creating a bug that can monitor what is going inside the room where the computer is. -

Two presidential administrations ago, credit default swaps were permitted without regulation. The last administration allowed it to continue and the Obama administration inherited the ensuing chaos. Derivatives traders are the real reason why the economy tanked. The Financial Times' Gillian Tett wrote a great article: http://www.ft.com/cms/s/0/5c28ad86-1250-11...?nclick_check=1 After all, during the past decade, the theory behind modern financial innovation was that it was spreading credit risk round the system instead of just leaving it concentrated on the balance sheets of banks. But the AIG list shows what the fatal flaw in that rhetoric was. On paper, banks ranging from Deutsche Bank to Societe Generale to Merrill Lynch have been shedding credit risks on mortgage loans, and much else. Unfortunately, most of those banks have been shedding risks in almost the same way -- namely by dumping large chunks on to AIG. Or, to put it another way, what AIG has essentially been doing in the past decade is writing the same type of insurance contract, over and over again, for almost every other player on the street. Far from promoting "dispersion" or "diversification," innovation has ended up producing concentrations of risk, plagued with deadly correlations, too. Hence AIG's inability to honor its insurance deals to the rest of the financial system, until it was bailed out by US taxpayers.

-

Luke I think you are going to easy on Google. They are testing how far they can go before people get fed up. They have access to your computer files. They have access to your email. They have access to your location. They have access to what your home looks like. They have a satellite that watches you. If you protest they can take your story out of their search results. If you do not like what they are doing then you must be further inconvenienced to take the time to find all the information they have on us and fill out a request for removal. What makes this point worse is that Google does not have to remove your content if they do not want to. Just try to contact them. They have no phone numbers.

-

A South Texas grand jury has indicted Vice President Dick Cheney and former Attorney General Alberto Gonzales on charges related to the alleged abuse of prisoners in Willacy County's federal detention centers. The indictment criticizes Cheney's investment in the Vanguard Group, which holds interests in the private prison companies running the federal detention centers. It accuses Cheney of a conflict of interest and "at least misdemeanor assaults" on detainees by working through the prison companies. Gonzales is accused of using his position while in office to stop an investigation into abuses at the federal detention centers. Another indictment charges state Sen. Eddie Lucio Jr. with profiting from his public office by accepting honoraria from prison management companies.

-

A New York City artist has created a "Zero Dollar Bill" to call attention to the financial crisis that's gripping Wall Street and Main Street. Laura Gilbert, who is a painter and a printmaker, will be passing out signed and numbered prints of the "Zero Dollar" in front of Wall Street establishments. The bill looks like a dollar bill except it has zeros in place of ones. Gilbert plans on handing out 10,000 of the bills to passersby in front of the nation's financial district. She said the artwork is meant to point out the "the destructive role of many financial institutions, inflation, and the decline of U.S. currency to the point of seeming worthlessness." Gilbert, like millions of other Americans, is outraged by what they see as fiscal mis-management.